<p>As we navigate the complexities of the automotive industry in 2025, car insurance companies are undergoing a significant transformation. The rise of emerging technologies, shifting consumer behaviors, and evolving regulatory landscapes are forcing insurers to adapt and innovate. In this article, we will explore the current state of car insurance companies in 2025, highlighting the key trends, innovations, and consumer expectations that are shaping the industry.

Introduction to Car Insurance Companies in 2025

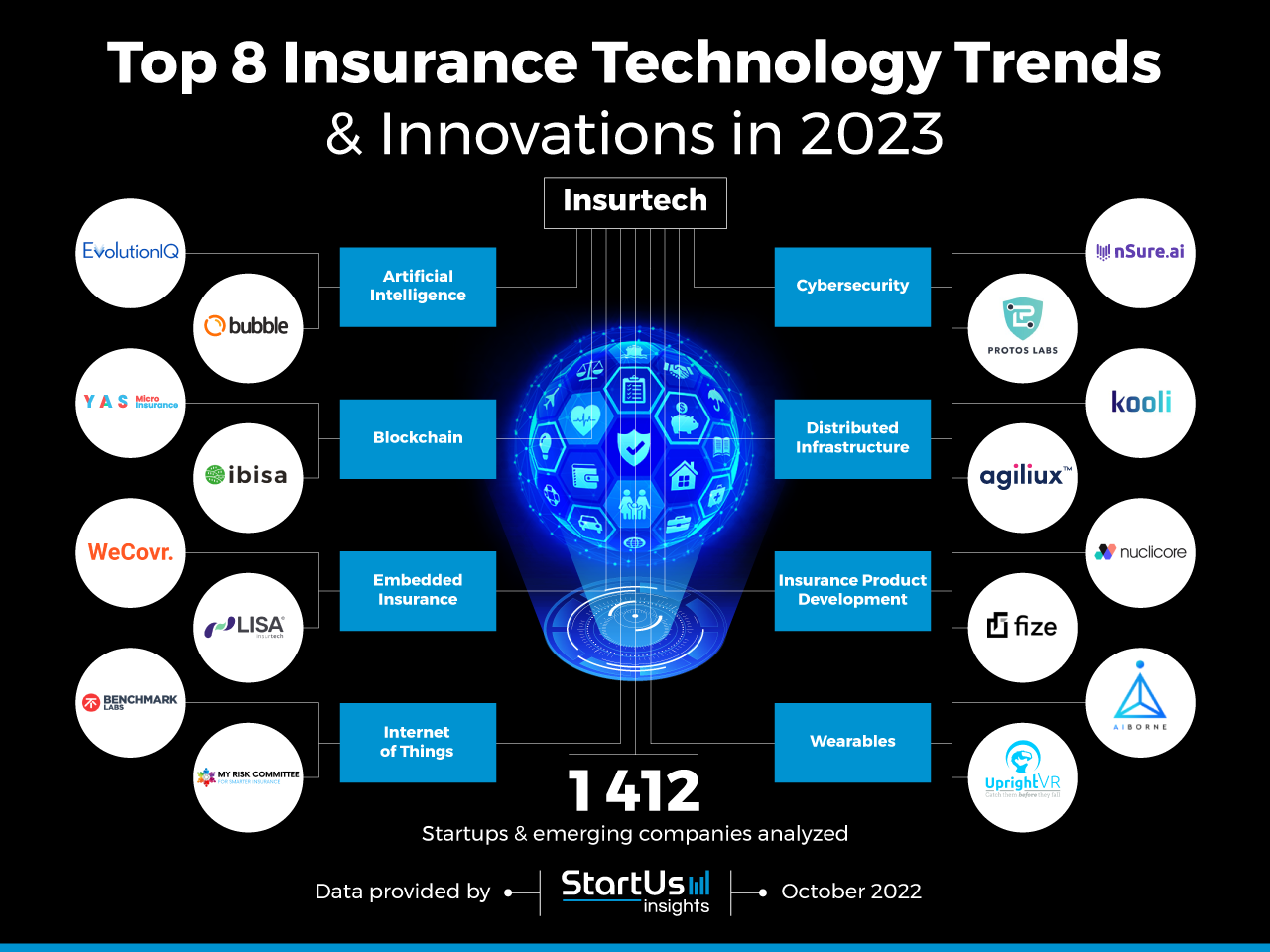

The car insurance industry has traditionally been characterized by a focus on risk assessment, premium calculation, and claims processing. However, with the advent of technological advancements, insurers are now leveraging data analytics, artificial intelligence, and the Internet of Things (IoT) to reimagine their business models. The goal is to provide more personalized, efficient, and cost-effective services to policyholders.

Trends Shaping the Car Insurance Industry in 2025

Several trends are influencing the car insurance industry in 2025, including:

- Telematics and Usage-Based Insurance (UBI): Insurers are increasingly using telematics devices to track driving behavior, mileage, and other factors to determine premiums. This approach enables more accurate risk assessment and encourages policyholders to adopt safer driving habits.

- Autonomous Vehicles and Connected Cars: The growing popularity of autonomous vehicles and connected cars is creating new opportunities for insurers to develop specialized products and services. These may include coverage for cyber risks, software updates, and data breaches.

- Digitalization and Online Platforms: Car insurance companies are investing heavily in digital platforms to enhance customer engagement, streamline processes, and reduce costs. Online portals and mobile apps enable policyholders to purchase policies, file claims, and access services more conveniently.

- Data-Driven Insights and Analytics: Insurers are leveraging advanced data analytics to gain deeper insights into policyholder behavior, risk patterns, and market trends. This enables them to develop more targeted marketing campaigns, optimize pricing strategies, and improve claims processing.

- Sustainability and Environmental Considerations: As consumers become more environmentally conscious, car insurance companies are responding by offering eco-friendly products and services. These may include discounts for electric or hybrid vehicles, carbon offset programs, and sustainable claims handling practices.

Innovations in Car Insurance Companies in 2025

Several innovations are transforming the car insurance industry in 2025, including:

- Artificial Intelligence (AI) and Machine Learning (ML): Insurers are applying AI and ML to improve claims processing, detect fraud, and enhance customer service. Chatbots, virtual assistants, and predictive analytics are becoming increasingly common.

- Blockchain and Distributed Ledger Technology: Car insurance companies are exploring the potential of blockchain to enhance data security, reduce fraud, and improve claims settlement efficiency.

- Internet of Things (IoT) and Connected Devices: The proliferation of IoT devices and connected cars is enabling insurers to collect more accurate and granular data on driving behavior, vehicle condition, and environmental factors.

- Mobile Apps and Digital Wallets: Insurers are developing mobile apps and digital wallets to provide policyholders with convenient access to services, documents, and claims information.

- Partnerships and Collaborations: Car insurance companies are forming partnerships with technology startups, fintech firms, and automotive manufacturers to develop innovative products and services.

Consumer Expectations in 2025

Policyholders in 2025 have evolving expectations from car insurance companies, including:

- Personalization and Tailored Services: Consumers expect insurers to offer personalized policies, premiums, and services based on their individual needs and preferences.

- Seamless Digital Experiences: Policyholders demand convenient, user-friendly online platforms and mobile apps to manage their policies, file claims, and access services.

- Transparent and Fair Pricing: Consumers expect insurers to provide transparent, fair, and competitive pricing, with clear explanations of premium calculations and discounts.

- Efficient Claims Processing: Policyholders expect fast, efficient, and hassle-free claims processing, with minimal paperwork and prompt settlement of claims.

- Sustainability and Social Responsibility: Consumers are increasingly expecting car insurance companies to demonstrate commitment to sustainability, social responsibility, and environmental stewardship.

FAQs

- What is telematics insurance, and how does it work?

Telematics insurance uses devices or mobile apps to track driving behavior, mileage, and other factors to determine premiums. This approach enables more accurate risk assessment and encourages policyholders to adopt safer driving habits. - How are car insurance companies using artificial intelligence and machine learning?

Insurers are applying AI and ML to improve claims processing, detect fraud, and enhance customer service. Chatbots, virtual assistants, and predictive analytics are becoming increasingly common. - What is the role of blockchain in car insurance?

Blockchain technology has the potential to enhance data security, reduce fraud, and improve claims settlement efficiency in the car insurance industry. - How are car insurance companies addressing sustainability and environmental concerns?

Insurers are responding to growing environmental concerns by offering eco-friendly products and services, such as discounts for electric or hybrid vehicles, carbon offset programs, and sustainable claims handling practices. - What are the key trends shaping the car insurance industry in 2025?

The key trends shaping the car insurance industry in 2025 include telematics and UBI, autonomous vehicles and connected cars, digitalization and online platforms, data-driven insights and analytics, and sustainability and environmental considerations.

Conclusion

The car insurance industry in 2025 is undergoing a significant transformation, driven by emerging technologies, shifting consumer behaviors, and evolving regulatory landscapes. Insurers are responding by leveraging data analytics, AI, and IoT to develop more personalized, efficient, and cost-effective services. As policyholders’ expectations continue to evolve, car insurance companies must prioritize innovation, sustainability, and customer-centricity to remain competitive. By embracing these trends and innovations, insurers can create new opportunities for growth, improve customer satisfaction, and contribute to a more sustainable and responsible industry.

Closure

Thus, we hope this article has provided valuable insights into The Evolution of Car Insurance Companies in 2025: Trends, Innovations, and Consumer Expectations. We appreciate your attention to our article. See you in our next article!