<p>As the world of insurance continues to evolve, temporary car insurance has become an increasingly popular option for drivers who only need coverage for a short period. Whether you’re borrowing a friend’s car, renting a vehicle, or need insurance for a test drive, temporary car insurance can provide the protection you need without the long-term commitment. In this article, we’ll explore the world of temporary car insurance in 2025, including its benefits, types, and what to look for when purchasing a policy.

What is Temporary Car Insurance?

Temporary car insurance, also known as short-term car insurance, is a type of insurance policy that provides coverage for a limited period, usually ranging from one day to 28 days. This type of insurance is designed for drivers who only need coverage for a short period, such as when borrowing a car, renting a vehicle, or driving a new car off the forecourt. Temporary car insurance policies typically offer the same level of coverage as a standard car insurance policy, including liability, collision, and comprehensive coverage.

Benefits of Temporary Car Insurance

There are several benefits to purchasing temporary car insurance, including:

- Flexibility: Temporary car insurance policies can be purchased for as little as a day or up to 28 days, providing flexibility for drivers who only need coverage for a short period.

- Cost-effective: Temporary car insurance policies are often cheaper than purchasing a standard car insurance policy, especially for drivers who only need coverage for a short period.

- No long-term commitment: Temporary car insurance policies do not require a long-term commitment, making them ideal for drivers who only need coverage for a short period.

- Wide range of coverage options: Temporary car insurance policies often offer a wide range of coverage options, including liability, collision, and comprehensive coverage.

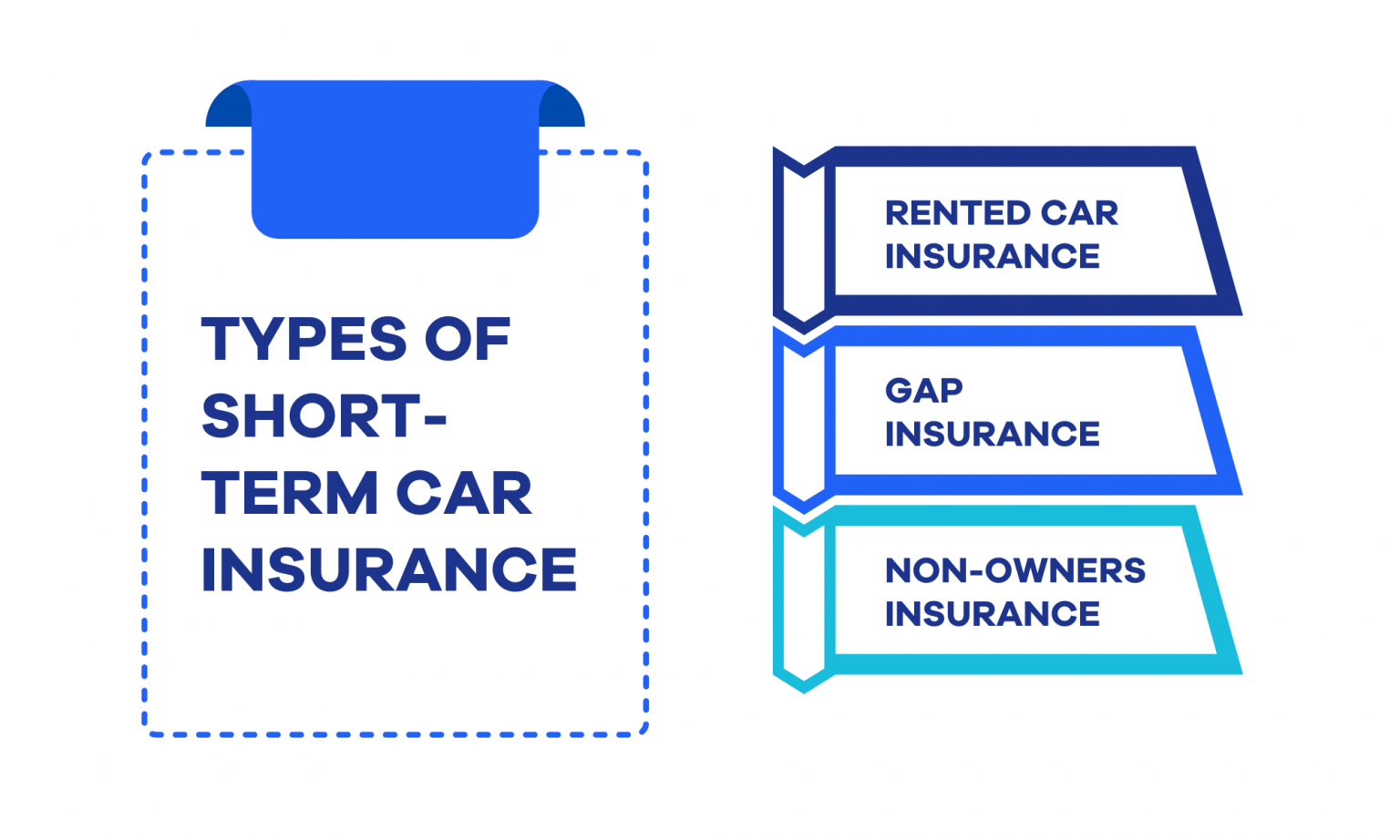

Types of Temporary Car Insurance

There are several types of temporary car insurance policies available, including:

- Daily car insurance: This type of policy provides coverage for a single day, making it ideal for drivers who only need coverage for a short period.

- Weekend car insurance: This type of policy provides coverage for a weekend, typically from Friday to Monday.

- Short-term car insurance: This type of policy provides coverage for a longer period, typically up to 28 days.

- Temporary car insurance for learners: This type of policy provides coverage for learner drivers who are practicing with a qualified instructor.

What to Look for When Purchasing Temporary Car Insurance

When purchasing temporary car insurance, there are several things to look for, including:

- Coverage options: Look for policies that offer a wide range of coverage options, including liability, collision, and comprehensive coverage.

- Policy duration: Consider the length of time you need coverage for and choose a policy that meets your needs.

- Price: Compare prices from different insurance providers to ensure you’re getting the best deal.

- Excess: Check the excess amount, which is the amount you’ll need to pay in the event of a claim.

- Provider reputation: Look for insurance providers with a good reputation and high levels of customer satisfaction.

How to Purchase Temporary Car Insurance

Purchasing temporary car insurance is relatively straightforward and can be done online or over the phone. To purchase a policy, you’ll typically need to provide some basic information, including:

- Vehicle details: You’ll need to provide details about the vehicle you’ll be driving, including the make, model, and registration number.

- Driver details: You’ll need to provide details about yourself, including your name, address, and driving license number.

- Policy duration: You’ll need to specify the length of time you need coverage for.

- Coverage options: You’ll need to select the coverage options you need, including liability, collision, and comprehensive coverage.

FAQs

- Q: Can I purchase temporary car insurance if I have a poor driving record?

A: Yes, but you may need to pay a higher premium or provide additional information to support your application. - Q: Can I cancel my temporary car insurance policy if I no longer need it?

A: Yes, but you may need to pay a cancellation fee, depending on the insurance provider. - Q: Will temporary car insurance cover me for driving abroad?

A: It depends on the insurance provider and the policy you purchase. Some policies may offer coverage for driving abroad, while others may not. - Q: Can I add additional drivers to my temporary car insurance policy?

A: Yes, but you’ll need to provide details about the additional drivers and pay an additional premium. - Q: Will temporary car insurance cover me for business use?

A: It depends on the insurance provider and the policy you purchase. Some policies may offer coverage for business use, while others may not.

Conclusion

Temporary car insurance is a flexible and cost-effective option for drivers who only need coverage for a short period. With a wide range of coverage options and policy durations available, temporary car insurance can provide the protection you need without the long-term commitment. When purchasing temporary car insurance, it’s essential to consider your coverage options, policy duration, price, excess, and provider reputation. By doing your research and choosing the right policy, you can enjoy peace of mind while driving, knowing you’re protected in the event of an accident or other unforeseen circumstances. Whether you’re borrowing a friend’s car, renting a vehicle, or need insurance for a test drive, temporary car insurance is an excellent option to consider.

Closure

Thus, we hope this article has provided valuable insights into Temporary Car Insurance 2025: A Comprehensive Guide. We thank you for taking the time to read this article. See you in our next article!